impulseSave®

Our goal with impulseSave® is simple – turn spenders into saver

We’ve lowered one of the key barriers to regular investment by making it possible for your client to add as little as £1 at a time to their investments through impulseSave®.

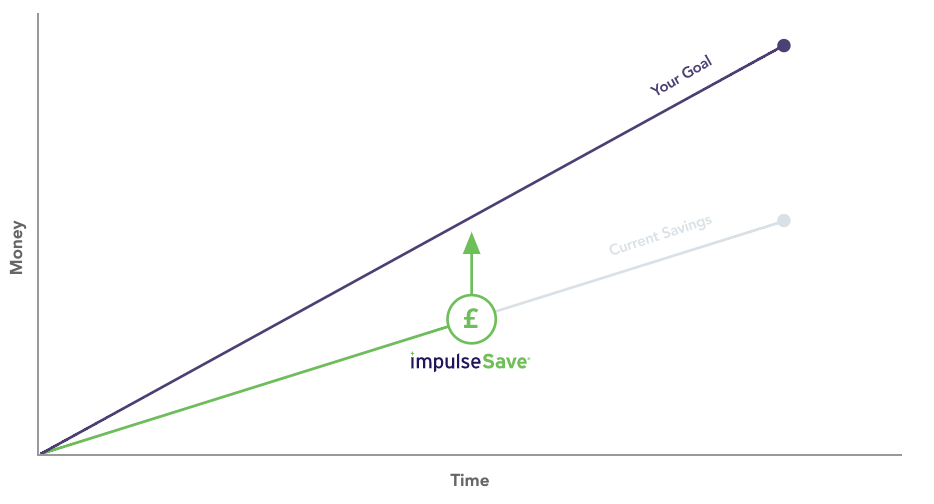

By empowering them to set financial goals, regularly review investments against those goals and top-up easily and quickly to close any gap, we’re helping your clients to form the habits of a long- term investor.